how do loans work at pawn shops

A collateral loan uses the value determined through an appraisal completed by the pawnbroker. The pawn shop keeps the.

Pawn Loans In North Carolina Oklahoma Georgia Virginia Texas Alabama Smart Pawn Jewelry

Loan terms interest rates and fees for pawn loans vary widely by state.

. When you get a loan. If you want a pawnshop loan the pawnbroker will not pull your credit but instead offer you a loan based on the value condition and resale potential of your item. To pawn an item we need just a few items from you.

You bring an item of value to a pawn shop and negotiate the terms of the loan including the amount interest rate and fees. The pawn shop loan issued by a pawnbroker correlates to the assessed value of your item. If you want a pawnshop loan the pawnbroker will not pull your credit but instead offer you a loan based on the value condition and resale.

After assessing its value the pawnshop may offer you a loan for 100 at 2 interest 2 plus a 20 fee 20. A pawn shop is a licensed and regulated broker that offers consumer credit fast loans secured by personal property. All you need in order to pawn an item and get a loan is a valuable item and a valid.

These loans are typically for 1-3 months but you can pay. The items you give to the pawnbroker are called collateral the basis of. You bring in an item as collateral and the pawnbroker will determine the value of the item give you a loan based on its cost and then.

The collateral loan process begins when you bring in a valuable item to the pawn shop and request a loan with your item as collateral. You take an item of value to the pawnbroker the shop evaluates it and gives you a loan for a percentage of the value. A helpful solution that can help you get the cash you need without sacrificing your credit score financial stability or a treasured item can be found at your local pawn shop.

A pawn loan is a fast method to borrow money because it does not involve a credit check or application process unlike a personal loan. Pawning is when you take an item you own to a pawn shop in exchange for money. The value of the.

Do they stick a gun to their head and say sell it to me for X or I will kill you. A pawnship primary function is to lend people. One way to think about the cost of your loan is to convert that per-month rate into an annual percentage rate APR.

To do that just multiply the interest rate by 12. A pawn shop loan is a collateral loan. The pawn shops owner or resident.

Second you will need to prove your identity by. Auto title and pawn loans typically require collateral while other options dont. The process for selling an item is pretty much standardized across most pawn shops.

The interest rates of the pawn loan usually range between 4-8 of the issued amount per month. Pawnbrokers dont give you what the item is. How Do Pawn Shop Loans Work.

How does a pawnshop have the posibility to rip someone off. When you return to repay. You can bring the pawn shop an item of value and the store immediately pays you the worth of that good.

How Do Pawnshop Loans Work. Give the customer a verbal. First you will need to have the item itself that you want to pawn.

Shops will typically hold your collateral for at least 30 days before selling it and charge interest rates of. The downside is that you risk losing your item and pawn shops usually charge high interest rates. Do a quick over the counter evaluation of the item.

Heres how pawn shop loans work. The pawnbroker will give you 1200 as long as you agree to pay back the loan as soon as possible. Pawn shops offer secured short-term loans.

Once the pawnbroker can figure out the value of your item the amount is used to. The amount you get. The item you offer.

A pawn shop loan is a secured quick cash loan that pawn shops give in exchange for holding onto collateral such as a television jewelry or musical instrument. Most of the time this is done using monthly payments. Say you decide to pawn a smartphone.

When you pawn something you use the item as collateral to receive a loan from the pawn shop. Getting a Pawn Loan.

How Do Pawn Shop Loans Work In South Florida

Here S What A Business Loan Can Do For Your Pawn Shop Retail Minded

How A Pawn Shop Works St Paul S Forklift Training Certification School Foreign Language

Should You Take A Pawnshop Loan Nerdwallet

How Do Pawn Shops Work 5 Reasons To Avoid Them Oppu

How Do Pawn Shops Work Cash 1 Blog News

How Does A Pawn Shop Loan Work Gelman Loan Pittsburgh Pa

Pawn Shop Loans Are They Ever Worth It Credible

How Do Pawn Shops Work 5 Reasons To Avoid Them Oppu

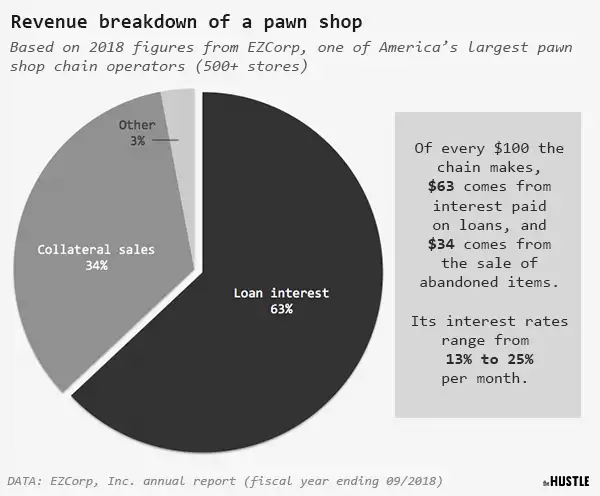

The Unpredictable Economics Of Pawn Shops The Hustle

How Do Pawn Shops Work How To Get A Loan Blog Pawnzone

What Is A Pawn Loan Lbc Boutique Loan

Pawn Shop Located In Pasadena Crown City Loan Jewelry